We never learn from a crisis

The one lesson we learn from history is that we learn nothing from history.

Take the banking crisis the world is now facing. It has an uncanny resemblance to the last banking crisis in 2007/8 – only 15 years ago.

Back then, the problem was that banks were lending money to almost anyone to buy homes. No matter that you didn’t have a job, had a lousy credit history or debts, the banks were shoving money through the grilles.

They were called subprime loans and were obviously high-risk.

This time around, banks are again in the high-risk business but this time it’s the technology sector. They all have FOMO – Fear of Missing Out – and this phobia is rife among them. Never mind that most tech companies never make a profit. What’s that?

Names like Uber, Spotify, Airbnb and the loss-making companies you’ve heard of, but there are hundreds more where the banks are still piling in.

Come up with an idea at breakfast and by lunchtime you’ll have the finance in place.

The 2007/8 crisis started with New Century Financial — one of the big lenders of subprime mortgages. Soon the crisis engulfed the whole sector and big names like Bear Stearns and Lehman Brothers went under.

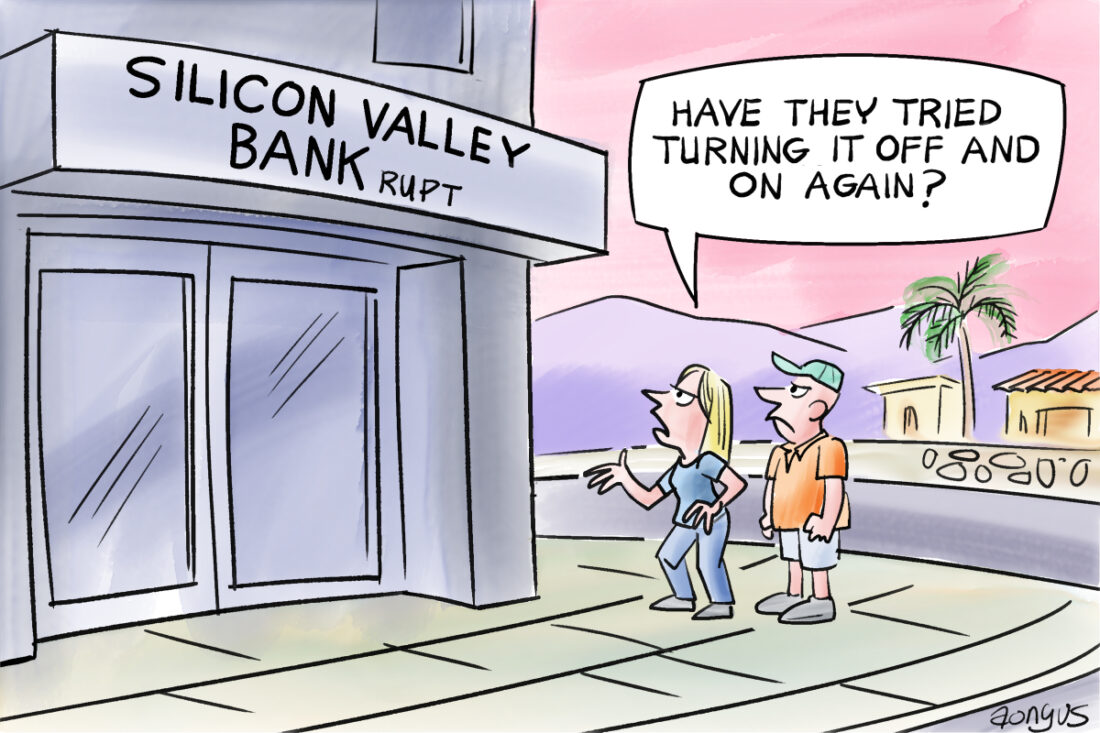

This time, it is Silicon Valley Bank that is leading the charge to the bottom. (Incidentally one of the pleas you should never make in a crisis is ‘don’t panic’ as it immediately makes everyone panic. It is exactly what Silicon Valley Bank CEO, Greg Becker asked last week. I panicked.)

Now the contagion has spread to some of the bigger banks like Credit Suisse which is desperately trying to stay alive. The similarities to 2007/8 are frightening.

At last, the tech companies are waking up and getting lean and mean. Microsoft, Google and Amazon are shedding jobs as they try to maintain that dirtiest of words: profit. The newly unemployed will only add to the current crisis.

And who bankrolls all of this massive risk-taking? Governments, also known as me and you.

And the bankers? In the subprime crisis, in the US, only one junior banker (by coincidence he worked for Credit Suisse) went to jail. For the rest, there’s an old rule: I’ll be gone, you’ll be gone, we’ll all be gone.

See you on the other side.

Have a good week.

Tom